BCT Digital, a global digital transformation company delivering FinTech, RegTech, and SustainTech solutions, in collaboration with Chartis Research, has published the findings of their extensive ESG and Climate Risk Survey. Titled ‘Chartis Market View: ESG and Climate Risk Survey’, it analyzes how global financial institutions are integrating ESG and climate risk factors into their risk management and investment decision-making processes.

The survey captured insights from 77 ESG and climate risk practitioners representing financial institutions with assets under management ranging from $1 bn to $500 bn based in the APAC, North America, Europe and the MENA region.

Key Findings

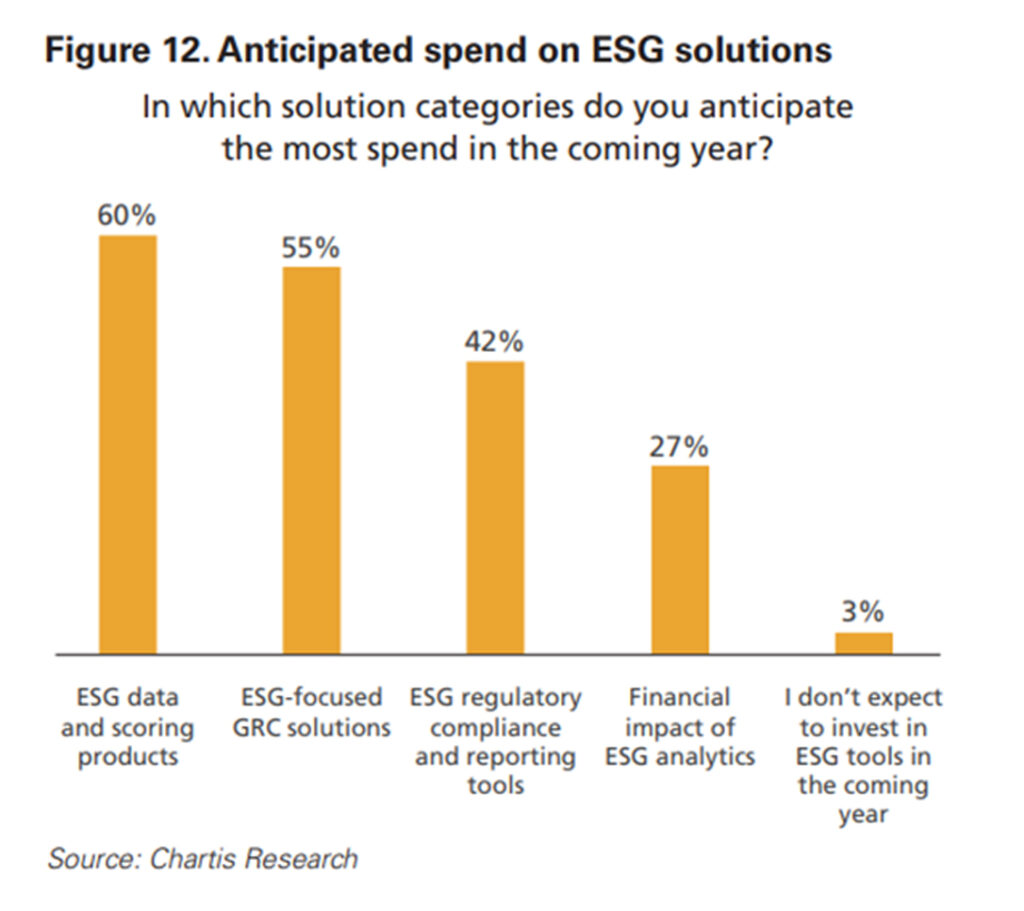

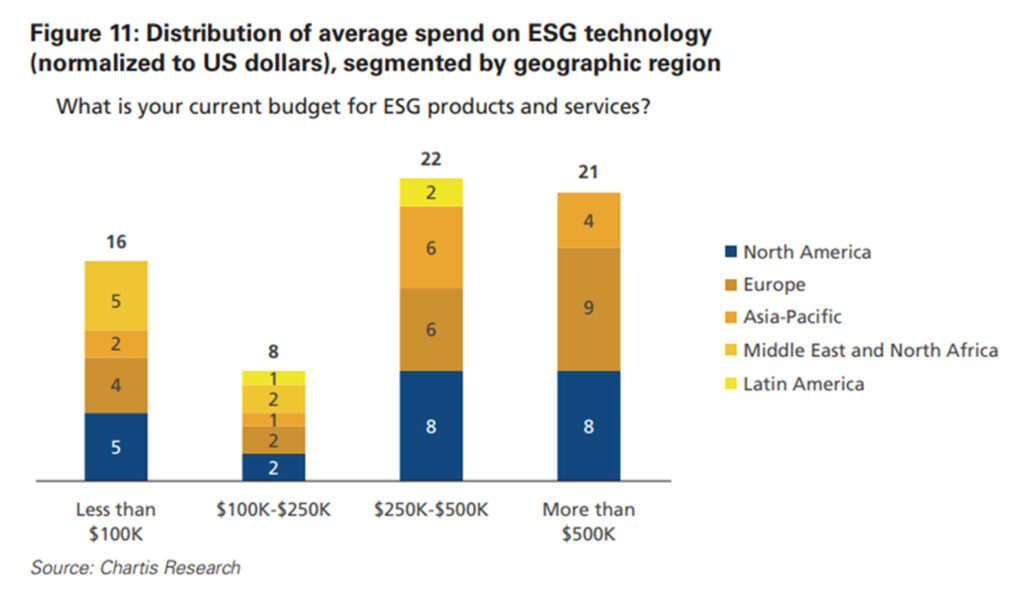

According to a press note by BCT Digital, most firms review their ESG strategies quarterly, spending an average of $250,000 to $500,000 annually, with North American and European institutions more likely to exceed $500,000. The next year’s investments are expected to focus on ESG data and scoring products, governance, risk management and compliance (GRC) solutions, and regulatory compliance and reporting tools.

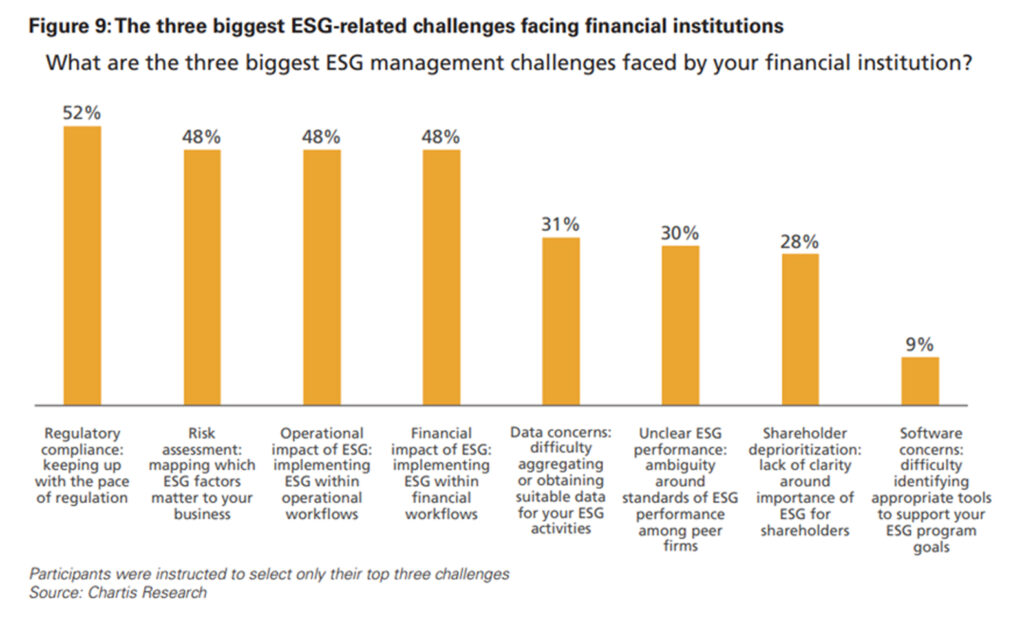

The note also shared the survey’s findings, which noted that 52% of the respondents indicated regulatory compliance, being the most significant ESG challenge. About 48% of the respondents identified risk assessment and mapping relevant ESG whereas another 48% viewed integrating ESG into operational and financial workflows as significant challenges.

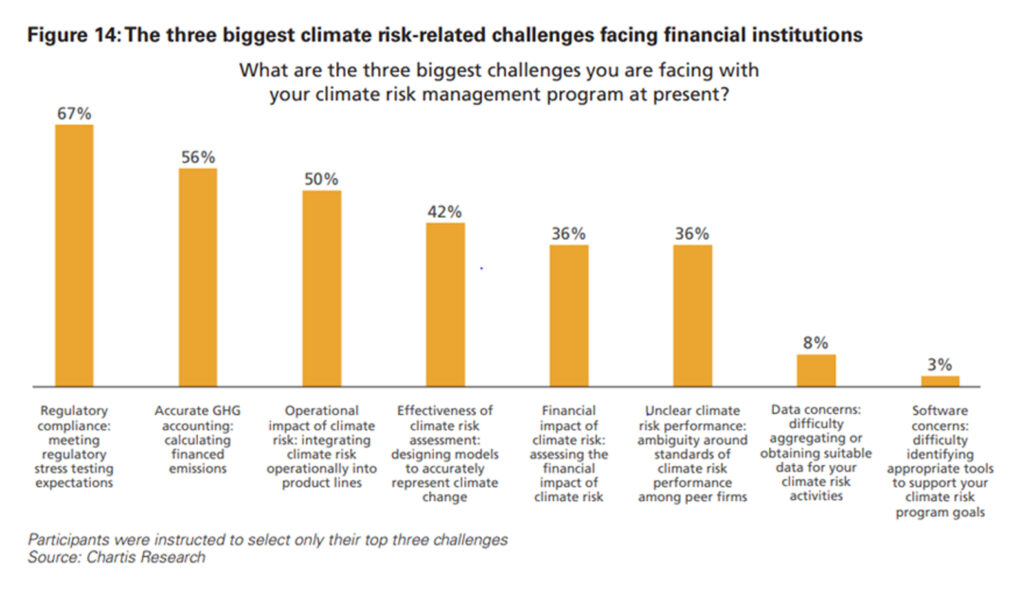

With respect to climate risk, the main challenges are meeting regulatory stress testing expectations (67%), accurate GHG (Greenhouse gas) accounting (56%) and integrating climate risk operationally into product lines (50%). Most firms spend between $250,000 and $500,000 on climate risk solutions, with future investments likely to be directed towards emissions data, transitional climate risk modeling, and regulatory reporting tools.

On the report launch, Jaya Vaidhyanathan, CEO, BCT Digital said: “There is a lack of uniformity in ESG and climate risk reporting standards; different countries and regions may have their own frameworks and definitions. This disparity makes it challenging for multinational corporations to maintain consistent reporting. The detailed findings of this survey provide valuable insights for financial institutions aiming to enhance their ESG and climate risk management frameworks.”

Sid Dash, Chief Researcher, Chartis said: “Data management is central to the compliance process. Having a fully integrated framework which enables data management across the entire value chain is crucial.”

The survey covered industry segments like retail, corporate and commercial banking, asset management, private wealth management, broker-dealers, cooperative banks, microfinance institutions, credit unions, and non-bank financial institutions. For more information, refer to the report.