While most large countries, including China, started climate taxonomy systems a few years back, India has woken up to its need only now. This is because only three per cent of foreign direct investments have been linked to climate finance so far although the need and potential has been much greater.

According to PwC’s Sambitosh Mohapatra, Partner and Leader – ESG, Climate and Energy, PwC India, by 2030, India will need $ One trillion to meet its green transition goals. The gap in funding, he estimates could be around $ 350 billion.

India can attract climate finance only with a robust climate taxonomy system. It appears to be fragile now. A lack of clarity on what constitutes sustainable activity is a big reason for low green finance flows.

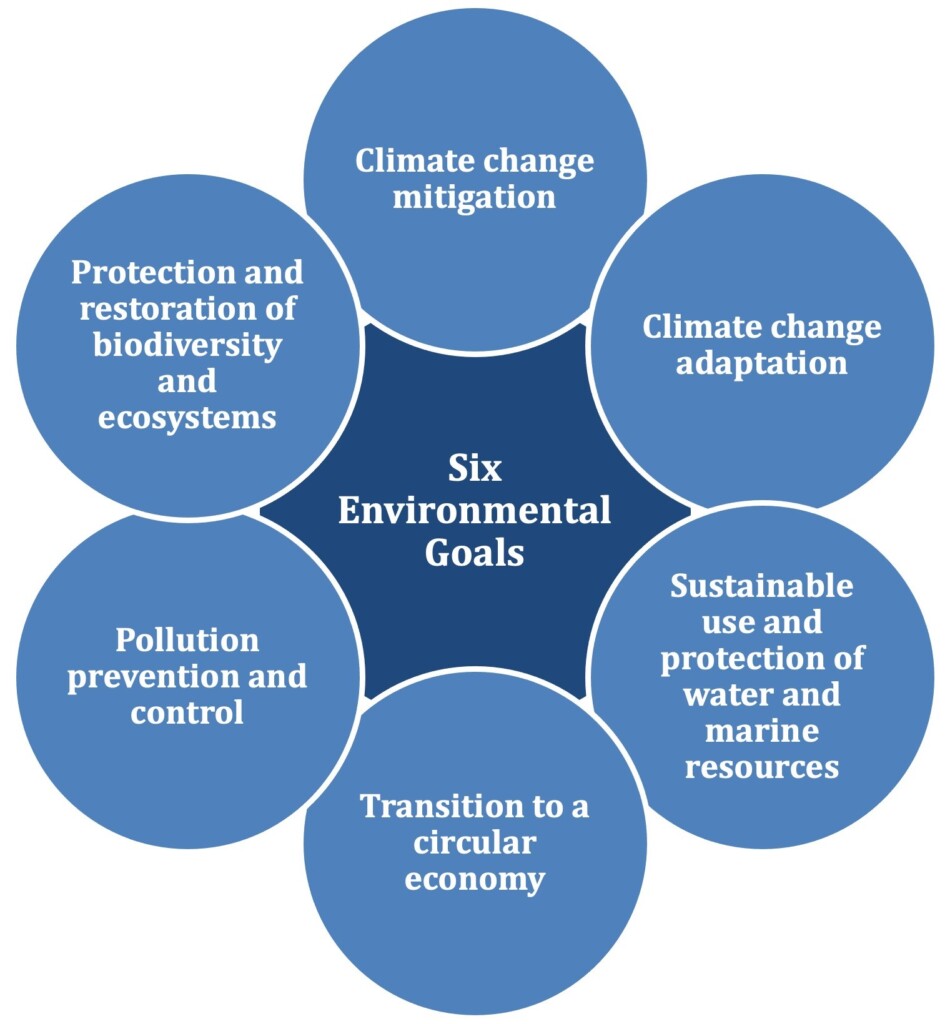

Climate taxonomy is a classification system that identifies which economic activities can be marketed as sustainable investments. It serves as a guide for investors and financial institutions to direct capital towards projects that contribute to climate adaptation and mitigation. They need to be aligned with broader environmental goals. Climate taxonomy will improve transparency, much needed in a system that favors crony capitalism.

Is India late in coming out with its climate taxonomy model? It feels like that because India had committed to achieving 50% of its cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030 in the 2015 Paris Agreement but what it has achieved so far falls well short. But experts believe India can catch up since a good foundation has been laid.

The 2024 Budget made a slew of announcements to accelerate the green transition. They include exemption of duty on 25 critical minerals to aid local manufacturing of key raw materials for the EV sector. The announcement of the ‘Critical Mineral Mission’ is a long-term plan to source minerals from within and from owning mines abroad.

Envisaging a scenario of surplus renewal energy, the budget aims to shift micro and SMEs to clean energy usage. What’s needed is an attractive transition plan which is implemented efficiently. Indian small businesses pay way too high a cost for power.

Small Nuclear Reactors

The second big highlight of the 2024 Budget for the green sector is promoting small nuclear energy plants. Called Bharat Small Reactors, the government is willing to incentivize the private sector to take up these projects. If done well, it will add nicely to the energy mix. The global debate is beginning to favour safer nuclear energy.

India currently has 23 operable nuclear reactors providing some 7,425 MWe of generating capacity, with seven units currently under construction, including both Indian-designed and Russian-designed units as well as one fast breeder reactor. It has plans for a fleet of Indian-designed and built 700 MWe pressurized heavy water reactors as well as for large reactors from overseas vendors, including further Russian-designed VVER reactors in addition to those already in operation and under construction at Kudankulam in Tamil Nadu.

India was planning to invite private firms to invest some $26 billion in its nuclear energy sector. It is holding talks with several private firms to secure investments to support the construction of some 11,000 MWe of new nuclear capacity by 2040.

With growing global geopolitical tensions, is it wise to make nuclear material easily accessible?

Waste to Energy Ignored

India has the potential to generate 5,690 MW of power from industrial waste and MSW. However, as of May 2023, the installed capacity stood at 556 MW, indicating the untapped potential of WTE

Waste to energy in India has not taken off because the calorific value of mixed Indian waste is about 1,500 kcal/kg, which is not suitable for power generation. Waste-to-energy plants require segregated and dried non-recyclable dry waste, which has a calorific value of 2,800-3,000 kcal/kg.

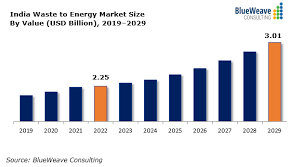

India’s waste-to-energy (WTE) market size was estimated at USD 2.25 billion in 2022. During the forecast period between 2023 and 2029, the size of India’s waste-to-energy (WTE) market is projected to grow at a CAGR of 4.23% reaching a value of USD 3.01 billion by 2029.

Without a healthy and robust power distribution system, it is silly to focus only on the generation of green power. Indian power distribution companies have been mismanaged, and there are no signs of that changing any time soon. With a growing share of RE to the mix and their power supply intermittent, state electricity boards’ job is getting complex. The future flow of climate finance needs to focus on power distribution efficiency and storage.