On March 21, 2024, while hearing a plea to protect the Great Indian Bustard (GIB) from losing its habitat due to power transmission lines, the Supreme Court reiterated that citizens have a right to a clean environment as it is integral to the citizens’ Right to Life guaranteed under Article 21 of the Constitution and the government must uphold this right. However, governments, both at the central and state levels, seem to be completely apathetic about it. Tellingly, discussions on the environment and climate change were absent throughout the entire election campaign despite the elections coinciding with deadly heat waves, floods and cyclones.

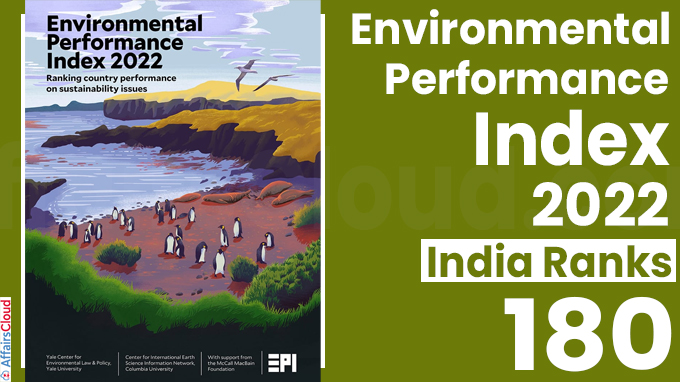

As a consequence of this apathy, India has one of the worst environmental indicators globally. The Global Environmental Performance Index (EPI), 2022, ranks India at the bottom among 180 countries (including Pakistan, Nepal, Bangladesh, Myanmar and Sri Lanka). India is the third biggest emitter of greenhouse gases. A severe heatwave is wreaking havoc across most of India currently. Nearly half of its rivers are polluted and 150 of its primary reservoirs are currently at just 38 percent of their total live storage capacity.

This poor environmental performance has serious implications for our health. 76 per cent of Indians live in areas where air quality does not meet national standards. Pollution is the largest cause of death in India. In 2019, nearly 1.6 million people died prematurely due to air pollution while 2.3 million died due to pollution overall. People’s life expectancy has reduced by 10 years in New Delhi and by 5-7 years in North India due to pollution.

Pollution also harms the economy. According to studies, India has lost 1.4 per cent of its GDP or about Rs. 2,60,000 crore due to premature deaths and morbidity from air pollution in 2019, while land degradation and land use change ate up 2.54 per cent of India’s GDP in 2014-15.

The other significant challenge the government faces today is the staggering rate of unemployment in the county. Unemployment levels among persons above 15 years of age increased from 2.3 per cent in 2000 to 4.1 per cent in 2022 while the number of unemployed persons rose from 9.2 million to 22.9 million.

Employment vs Environment

Employment and environment are often pitted against each other, and the environment is often sacrificed, ostensibly to promote employment. This approach has resulted in the current crises of environment and employment. Therefore, the twin crises of employment and the environment need to be addressed simultaneously. This is possible by focusing on ‘Green Jobs’ – jobs which contribute positively to the environment while also providing decent, dignified and safe working conditions for those involved in them. These include research and production of environmentally sustainable goods and services. According to a report, India has the potential to generate nearly 35 million green jobs by 2047.

Achieving this goal requires us to recognise that pollution has a ‘social cost’, which means it impacts people who are not direct participants in the process of production and consumption of goods and services. The role of the state is to ensure this social cost is minimised. The solution to this, first proposed by Arthur Pigou in his 1920 book, The Economics of Welfare, was to impose an additional pollution tax, also called a ‘Pigouvian tax’ on polluting activities. Such a tax or penalty disincentivises polluting activities while motivating producers and consumers to find sustainable alternatives and incentivising those engaged in green jobs.

To illustrate, chips, biscuits, shampoo sachets, chocolates, candies etc. may bring utility to the consumers of these products and profit to their producers. But they pollute the environment for everyone – particularly when they come in single-use plastic packaging. A pollution tax on such packaging will raise its cost. Consequently, consumers may shift to sustainably packaged products (thereby raising their demand and potential to create livelihoods) while companies will shift to sustainable packaging (thereby increasing green jobs in research and production of these).

A pollution tax on single-use plastic plates may promote green jobs in the production of leaf plates or research of other sustainable materials for plates. A study by this author showed that this approach would create nearly 3 lakh additional green jobs and generate additional incomes of up to Rs. 7600 crores in waste management alone.

If the newly-formed government is serious about protecting people’s right to a clean environment while addressing unemployment, it will have to take measures to disincentivise and penalise polluters while supporting those engaged in sustainable practices. Such an approach will promote a transition to sustainability, and support all those engaged in traditional sustainable livelihoods (like waste pickers, leaf bowl makers, Non-timber Forest Products (NTFP) collectors etc.) as well as the modern ‘ecopreneurs’ engaged in finding sustainable solutions through technology and sustainable businesses.

Anjor Bhaskar is a faculty member at Azim Premji University.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views or the positions of the organisation they represent.