India’s MSME sector, vital to its economy, requires a strategic shift towards sustainable practices. Europe’s diverse incentive models offer a roadmap. While India’s recent budget has provided a foundation, expanding financial instruments, strengthening regulations, and fostering innovation are crucial. Establishing green technology clusters, supply chain programs, and digital finance platforms can accelerate this transition. By prioritizing these measures, India can empower its MSMEs to drive a resilient and eco-conscious future, ensuring their competitiveness in a rapidly evolving global market.

For the financial year 2023-24, micro, small and medium Enterprises (MSMEs) contributed approximately 44% to India’s GDP in terms of Gross Value Added (GVA). For the year 2024-25, the projected contribution will increase to ~46%.

Proportionately, their carbon footprint is also on the upward swing. This necessitates a rapid shift towards sustainable practices. While India’s Budget 2025 has rolled out supporting measures, an analysis of European Union (EU)’s incentives, particularly in the Germany, France, Netherlands, Spain, and Italy, reveals a multifaceted approach that India can learn from. Demonstrating its commitment, the EU has allocated Euro 800+ billion for green investments under the NextGenerationEU recovery plan. In contrast, India’s current climate finance landscape sees only ~15% of MSMEs choosing to access formal financing.

Furthermore, a 20% increase in green-tech adoption is seen in EU’s MSMEs in the past 5 years. This success can be attributed to their incentive structures. In India, a SIDBI supported Sustainability Perception Index indicates that over 60% of MSMEs cite financial barriers as a primary roadblock towards delivering on sustainability goals, underscoring the need for enhanced support. These facts should be noted in the context of EU’s Carbon Border Adjustment Mechanism (CBAM), making sustainability compliance a critical concern.

Europe’s Mosaic of Incentives

A five-nation perspective of Europe’s approach to incentivizing MSMEs to access green capital is not similar. In the Netherlands, the subsidy for energy and climate innovations (DEI+) scheme has led to a 15% increase in MSME participation in green tech development since its inception. Germany’s KfW bank, through its tailored MSME programs, has facilitated Euro 50+ billion in green loans, significantly boosting energy efficiency projects.

France’s “France Relance” plan has allocated Euro 30 billion specifically for MSME green transition, with a focus on circular economy initiatives resulting in a 25% decrease in waste among participating businesses. Spain, leveraging “Next Generation EU” funds, has seen a 40% rise in MSME renewable energy installations, driven by accessible credit lines from the Instituto de Crédito Oficial (ICO).

Italy’s “National Recovery and Resilience Plan” has directed about Euro 60 billion towards the green transition, with a significant portion dedicated to MSME support, resulting in a 30% increase in energy-efficient building renovations. Across such nations, common threads emerge: a blend of innovative regulatory frameworks, direct financial support, and advisory services have built ‘green’ capabilities.

India’s Budgetary Boost

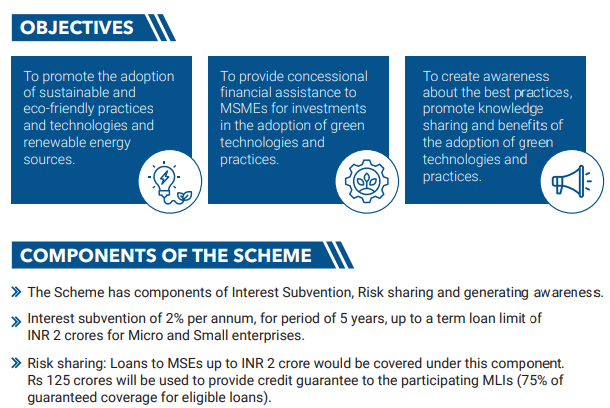

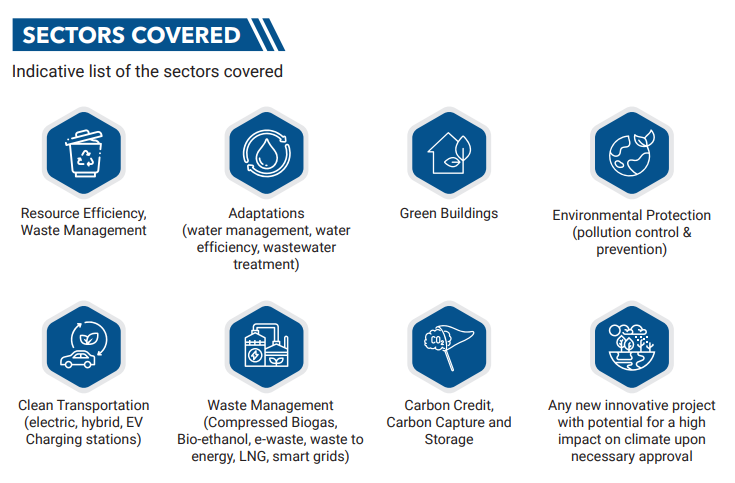

Over 1 million MSMEs are expected to benefit from India’s Budget 2025 as it unlocks INR 2 trillion in additional lending, while the lowering collateral requirements. SIDBI’s MSME-GIFT scheme, with a budget of INR 10000 Crore, aims to develop an ecosystem wherein institutional finance is made available at a concessional cost to minimize the incremental cost of clean/green technologies. As an example, SIDBI and private sector power players aim to finance rooftop solar installations for 10000+ MSMEs in the first year. Additionally, the recently announced enhanced turnover limits for MSMEs to INR 250 crore allows companies to retain their MSME status.

Bridging the Data and Capacity Gap

A critical aspect of Europe’s success lies in its emphasis on data transparency and capacity building. A standardizing reporting framework with an aim for 50% of eligible MSMEs to adopt Business Responsibility and Sustainability Reporting (BRSR) within 5 years can be considered. Comprehensive advisory services rolled out through digital modes can quickly train and empower MSMEs to navigate the nuances of green finance and follow-on sustainability practices. The implementation of a dashboard portal for reporting progress on MSME sustainability metrics, built on a robust data funnel, could reduce costs by 30% and enhance data accessibility at scale.

Novel Ideas: Green Technology Clusters

Establishing dedicated greenfield/brownfield clusters in India where MSMEs can access shared green technology infrastructure, training, and financing should be taken up by the union government in collaboration with states. This can leverage economies of scale and reduce investment burdens and foster inter-disciplinary synergy while creating green jobs.

Infusing digital platforms of banks and other financing agencies with features that connect MSMEs with green finance providers, simplify application processes, and offer personalized sustainability assessments can be a quick win for all stakeholders. Leveraging supply-chain specific interventions that can reduce the carbon footprint involved in movement of people and goods can positively impact MSMEs in sectors like e-mobility, e-commerce, infrastructure planning, warehousing etc.

Implementing programs that partner with large corporations to provide technical and financial assistance to their MSME suppliers for sustainability improvements should be encouraged. This would create a cascading effect of sustainability throughout the supply chain. For the starts, a pilot program can be co-developed with top 5 major Indian corporations to attempt to reduce their supply chain emissions by 10-15% within 2 years.

Prasad Ashok Thakur, a CIMO scholar, is an alumnus of IIT Bombay and IIM Ahmedabad. Labanya Prakash Jena is a well-known climate finance expert