Introduction

In 2024, the carbon market stands at a pivotal juncture marked by a qualitative shift and geopolitical considerations. While carbon pricing remains an inevitable force, the exact mechanisms supporting it are shrouded in uncertainty. The landscape, navigating through months of turbulence, is directing its attention toward prioritizing high integrity over rapid expansion. This emphasis on quality over quantity signifies a critical transition within the carbon market, underscoring the industry’s commitment to robust and trustworthy practices as it navigates the complexities of a changing global environment.

The year ahead holds the promise of a nuanced and thoughtful approach to carbon pricing, steering away from hurried growth towards a more measured and principled trajectory.

Quality Concerns and the Voluntary Carbon Market (VCM)

The Voluntary Carbon Market (VCM), valued at $2 billion, faced a credibility crisis in 2023, leading to significant shifts in its landscape and operations. Key developments include:

Crisis Overview:

- The VCM experienced a credibility crisis in 2023, primarily triggered by concerns about the efficacy of projects and carbon credits.

- This crisis prompted a reevaluation of strategies among major players within the market.

Key Players’ Challenges:

- Verra Overhaul: As the world’s largest carbon registry and a major issuer of carbon credits, Verra initiated a comprehensive overhaul of its methodology. The aim was to enhance the overall process and quality of forest carbon offsets.

- South Pole Restructuring: South Pole, a leading carbon credits trader, ended its involvement in the Kariba REDD+ project in Zimbabwe. This decision followed reports suggesting significant overestimation of emissions avoided. The controversy surrounding this project led to the resignation of South Pole’s CEO Renat Heuberger.

Plunge in Nature-Based Credit Prices:

- Prices of nature-based carbon credits, a crucial category in the VCM, experienced a notable decline. For instance, the Platts Nature-Based Avoidance 2023 credit price hit a low of $4.50/mt of CO₂, a significant drop from the January high of $11.60/mt of CO₂.

Industry Initiatives for Higher-Quality Offsets:

- In response to the crisis, industry initiatives such as the Integrity Council for Voluntary Carbon Markets (ICVCM) and the Voluntary Carbon Markets Integrity Initiative have been introduced.

- These initiatives aim to define and establish standards for higher-quality offsets, addressing the concerns raised about the integrity and effectiveness of existing and future projects.

In summary, the credibility crisis in the VCM has instigated a series of transformations, prompting key players to take corrective measures and industry-wide initiatives to redefine standards for higher-quality carbon offsets.

Compliance Carbon Market Resilience

The compliance carbon market, in contrast to the voluntary sector, showcased resilience in the face of geopolitical uncertainties and economic challenges. Key aspects of this resilience include:

Robust Government Revenues:

- Government revenues from carbon pricing mechanisms within compliance markets reached an estimated $100 billion in 2023. This underlines the significance of carbon pricing as a crucial component of government climate policies.

Geopolitical Implications of CBAM:

- The introduction of the EU’s Carbon Border Adjustment Mechanism (CBAM) added a layer of complexity to global trade and heightened geopolitical tensions.

- China and India, among other nations, opposed the CBAM and proposed multilateral talks through the World Trade Organization to address their concerns.

CBAM’s Objectives:

- The CBAM aims to level the playing field in international trade by imposing a tax on imports of carbon-intensive materials and products into the EU.

- It specifically targets materials like aluminum, cement, electricity, fertilizers, hydrogen, iron, and steel. The CBAM aligns with the EU’s commitment to net- zero and exerts pressure on energy-intensive industries to decarbonize.

Addressing Carbon Leakage:

- One of the primary objectives of CBAM is to reduce the risk of carbon leakage, where EU industries might relocate abroad to evade stringent carbon regulations.

- The mechanism encourages importer nations to implement their carbon markets, fostering global efforts to limit carbon impacts on traded goods.

Trade and Political Tensions:

- The CBAM has resulted in increased trade and political tensions, especially between developed nations like the EU and developing nations like China and India.

- The pushback against CBAM reflects the broader debate on the equitable distribution of responsibilities in the global effort to combat climate change.

In summary, the compliance carbon market demonstrated resilience in terms of substantial government revenues, while the introduction of the EU’s CBAM introduced new geopolitical dimensions and trade tensions, particularly with opposition from major economies like China and India.

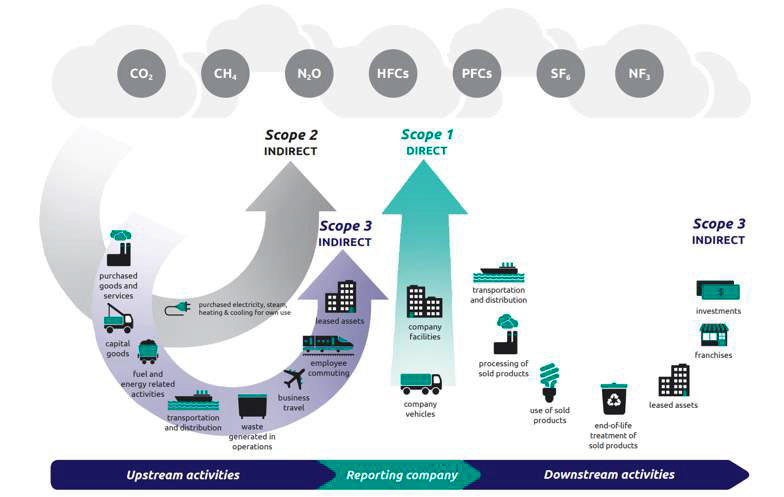

Scope 3 Disclosure and Sustainability Expectations:

Companies are encountering heightened expectations and scrutiny in the realm of sustainability reporting, particularly regarding Scope 3 emissions. This is reflected in several key aspects:

Comprehensive Emission Disclosure:

- Companies are expected to move beyond reporting only direct emissions from their operations and value chain. The focus has expanded to include Scope 3 or indirect emissions.

- This comprehensive approach aims to provide a holistic view of a company’s environmental impact, considering emissions not only within its boundaries but also upstream and downstream in the value chain.

ISSB’s Disclosure Standards:

- The International Sustainability Standards Board (ISSB) has played a pivotal role by introducing disclosure standards that cover general sustainability concerns (IFRS S1) and climate disclosures (IFRS S2).

- These standards set clear guidelines for companies to report on various aspects of sustainability, ensuring transparency and comparability across industries.

Legislative Impact on Reporting:

- New legislation enforcing stricter environmental reporting guidelines and sustainability practices contributes to the increased attention on disclosure.

- Companies are proactively adapting to these regulations, emphasizing the need for voluntary reporting structures that go beyond mere compliance.

Science-Based Targets Initiative (SBTi):

- Many companies are demonstrating their commitment to sustainability by pursuing the approval of science-based targets through initiatives like the Science Based Targets initiative (SBTi).

- SBTi mandates reporting on relevant Scope 3 emissions, aligning with the broader trend of embracing transparency and genuine commitment to sustainability efforts.

Increased Scrutiny and Pressure:

- The combination of heightened scrutiny from government bodies and key stakeholders is compelling companies to take proactive measures to enhance transparency.

- Voluntary reporting structures, coupled with the adoption of science-based targets, showcase a commitment to addressing not only direct emissions but also the broader environmental impact of operations.

Expectations from New Legislation:

- The introduction of new legislation and standards, such as those from ISSB, sets the stage for increased expectations in terms of the depth and breadth of sustainability reporting.

- Companies are likely to face more significant pressure to provide comprehensive and accurate disclosures, aligning with the global push towards sustainability.

In conclusion, the landscape of sustainability reporting is evolving, with a particular focus on Scope 3 emissions. Companies are navigating the complex terrain of standards, legislation, and stakeholder expectations to embrace transparency and actively contribute to sustainable development.

Transparency and Trust in Sustainability Initiatives

In the dynamic landscape of environmental, social, and corporate governance (ESG) initiatives, the pivotal factors of trust and reassurance take center stage. The industry is undergoing a transformative shift, steering away from greenwashing practices that have marred the authenticity of sustainability efforts. Consumers, now more than ever, demand transparency from brands, expecting them not only to adopt environmentally friendly practices but also to take a leadership role in addressing pressing environmental issues.

The paradigm extends beyond mere carbon reduction plans; consumers seek detailed insights into how companies are actively minimizing their ecological footprint. This includes transparent measures to reduce food waste, optimize energy consumption, and unequivocally support overarching sustainability endeavors.

The era demands a deeper, more authentic commitment from brands, encouraging them to be transparent about the tangible steps taken toward sustainable practices. Companies that champion transparency not only meet consumer expectations but also contribute significantly to fostering a genuine culture of sustainability and environmental responsibility.

Elections, Geopolitics, and the Sustainability Agenda

Against the backdrop of Asia’s bustling political landscape, where 40 national elections are slated to unfold, the sustainability agenda faces both continuity and challenges. Visionary leaders such as Indonesia’s Joko Widodo and India’s Narendra Modi have demonstrated commitments to specific sustainability goals. Widodo, for instance, championed a ban on nickel ore exports three years ago, aiming to bolster the local smelting industry and enhance welfare.

However, challenges loom large, particularly in Indonesia, where the downstream impacts of industries like nickel have sparked environmental concerns, from loss of forest areas to heightened crime rates. While the incoming administrations are expected to adhere to established climate change policies, addressing the complex downstream ramifications of industries remains a critical aspect of advancing the sustainability agenda in the Asian political landscape.

Conclusion

As we step into the pivotal year of 2024, it stands as a watershed moment for climate disclosure, the evolution of low-carbon business models, and the strategic application of

technology for enhanced accountability. The business landscape resonates with a compelling call for proactive adaptation to the ever-changing regulatory dynamics, underlining the importance of transparency and authentic commitment to sustainable development.

Navigating the intricate pathways of the green agenda in 2024 necessitates not only a keen awareness of regulatory shifts but also a steadfast dedication to a robust, data-driven approach to sustainability. This approach isn’t merely a response to compliance; it’s a proactive stance in shaping the future of sustainable development, urging businesses to go beyond the obligatory and actively contribute to the global goals of environmental responsibility and resilience.