Pressure eased in 2023 on the market for minerals that go into electric vehicles, wind turbines, solar panels and other clean energy technologies, as supply outpaced surging demand. But a new report from the International Energy Agency finds that major additional investments are still needed to meet the world’s energy and climate objectives.

The Global Critical Minerals Outlook 2024, published recently, updates the IEA’s inaugural review of the market last year while also offering new medium- and long-term outlooks for the supply and demand of important energy transition minerals, such as lithium, copper, nickel, cobalt, graphite and rare earth elements.

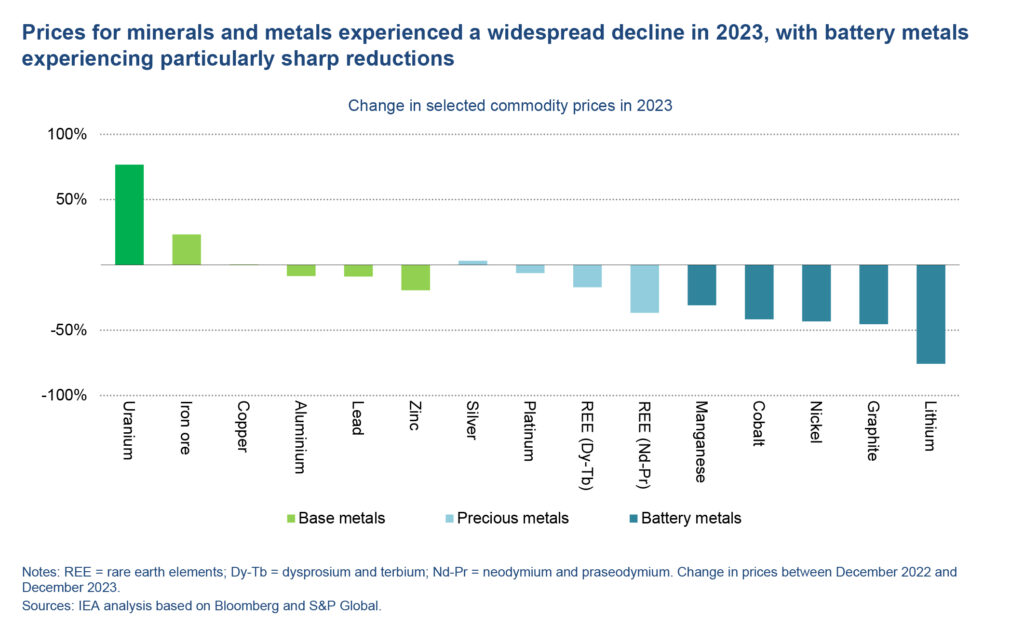

Following two years of dramatic increases, the prices of critical minerals fell sharply in 2023, returning to levels last seen before the pandemic. Materials used to make batteries saw particularly significant decreases, with the price of lithium dropping by 75% and the prices of cobalt, nickel and graphite falling by between 30% and 45% – helping drive battery prices 14% lower. With demand growth remaining robust, these declines were mostly driven by a strong increase in global supply – helping to offset the steep price rises in 2021 and 2022.

The report finds that while lower prices for critical minerals in the past year have been good news for consumers and affordability, they have also provided a headwind for new investment. In 2023, investment in critical minerals mining grew by 10% and exploration spending rose by 15% – still healthy, but slower than in 2022.

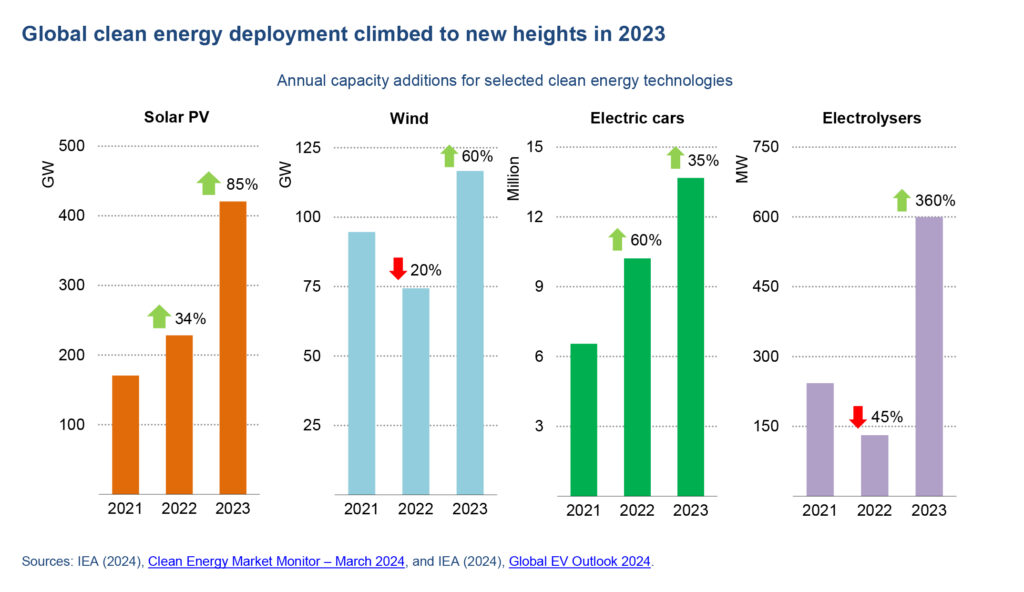

Today’s well-supplied market may not be a good guide for the future, with the Outlook noting that demand for critical minerals continues to grow strongly in all IEA scenarios, driven by the deployment of clean energy technologies.

The current combined market size of key energy transition minerals is set to more than double to $770 billion by 2040 in a pathway to net zero emissions by mid-century. Detailed project-by-project analysis suggests that announced projects are sufficient to meet only 70% of copper and 50% of lithium requirements in 2035 in a scenario in which countries worldwide meet their national climate goals. Markets for other minerals look more balanced – if projects come through as scheduled. However, announced projects do not change the high geographical concentration of supply, and China is projected to retain a very strong position in the refining and processing sector.

“Secure and sustainable access to critical minerals is essential for smooth and affordable clean energy transitions. The world’s appetite for technologies such as solar panels, electric cars and batteries is growing fast – but we cannot satisfy it without reliable and expanding supplies of critical minerals,” said IEA Executive Director Fatih Birol. “The recent critical mineral investment boom has been encouraging, and the world is in a better position now than it was a few years ago, when we first flagged this issue in our landmark 2021 report on the subject. But this new IEA analysis highlights that there is still much to do to ensure resilient and diversified supply.”

The latest Outlook features a first-of-its-kind risk assessment for selected energy transition minerals, scrutinising four key dimensions: supply risks, geopolitical risks, barriers to responding to supply disruptions, and exposure to environmental, social and governance (ESG) and climate risks.

Lithium and copper are the most vulnerable to supply and volume risks, while graphite, cobalt, rare earths and nickel face more substantial geopolitical risks. For graphite in particular, today’s project pipeline indicates that the available supply outside of the dominant player meets only 10% of the requirements in 2030, making announced diversification goals highly challenging to achieve. Most minerals are exposed to high environmental risks.

Recycling and Reuse

Stepping up efforts to recycle, innovate and encourage behavioural change is vital to ease potential strains on supply. Some $800 billion of investment in mining is required between now and 2040 to get on track for a 1.5 °C scenario. Without the strong uptake of recycling and reuse, mining capital requirements would need to be one-third higher.

The report finds that the industry is making progress on worker safety, gender balance, community investment and using renewable energy for mineral production. However, the same cannot be said for reducing waste generation, greenhouse gas emissions and water consumption – suggesting ample scope for improvement.

The latest Outlook is accompanied by an updated version of the IEA’s Critical Minerals Data Explorer, an interactive online tool that allows users to explore the latest projections. Both form part of the Agency’s expanding work on critical minerals, as requested by governments. The IEA recently hosted a Critical Minerals and Clean Energy Summit at its headquarters in Paris and is also working on a new voluntary Critical Minerals Security Programme that was launched at the IEA Ministerial Meeting in February 2024.