As the world transitions towards cleaner energy sources and electric mobility, the demand for lithium-ion batteries (LIBs) has skyrocketed. In India, this trend is particularly pronounced, with the government pushing for electric vehicle (EV) adoption and the growth of renewable energy sources. However, with this surge in demand comes the challenge of managing the end-of-life disposal of lithium batteries. Recycling plays a crucial role in mitigating environmental impact and ensuring the sustainable use of resources. In this article, we’ll explore the current capacity and future challenges of lithium battery recycling in India.

Indian Market Overview

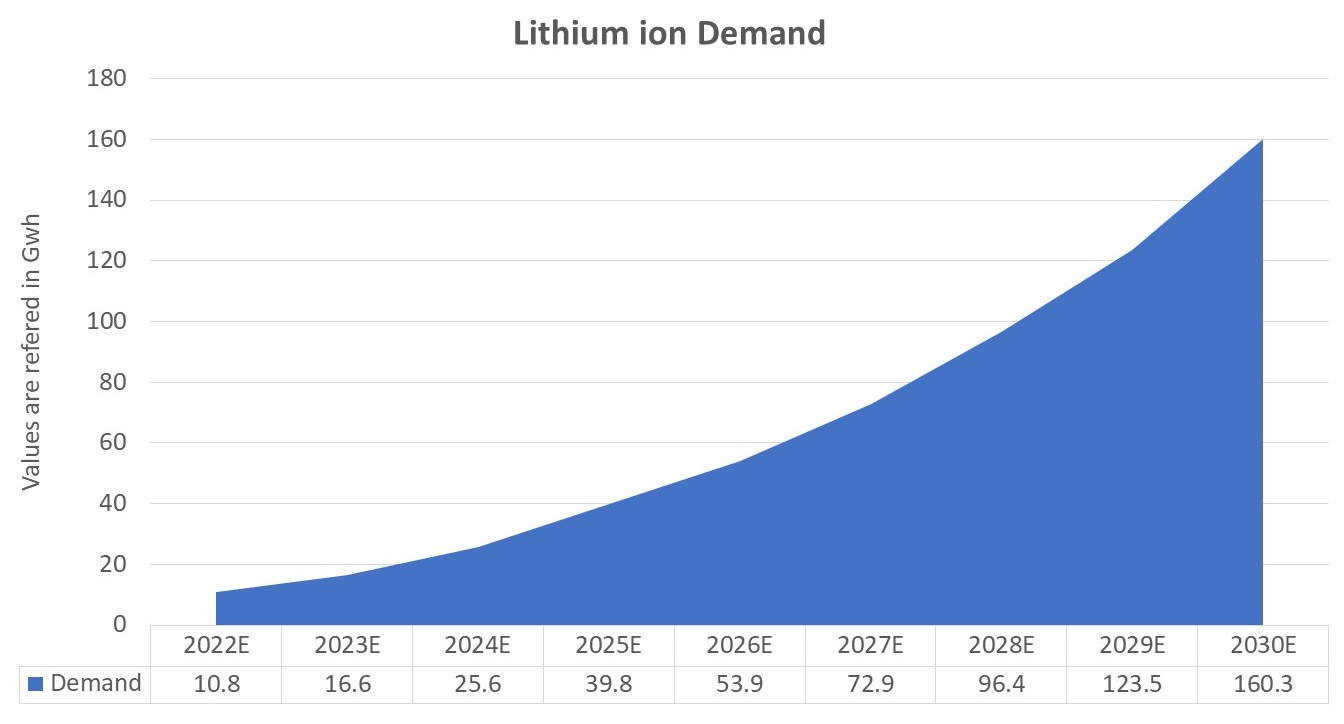

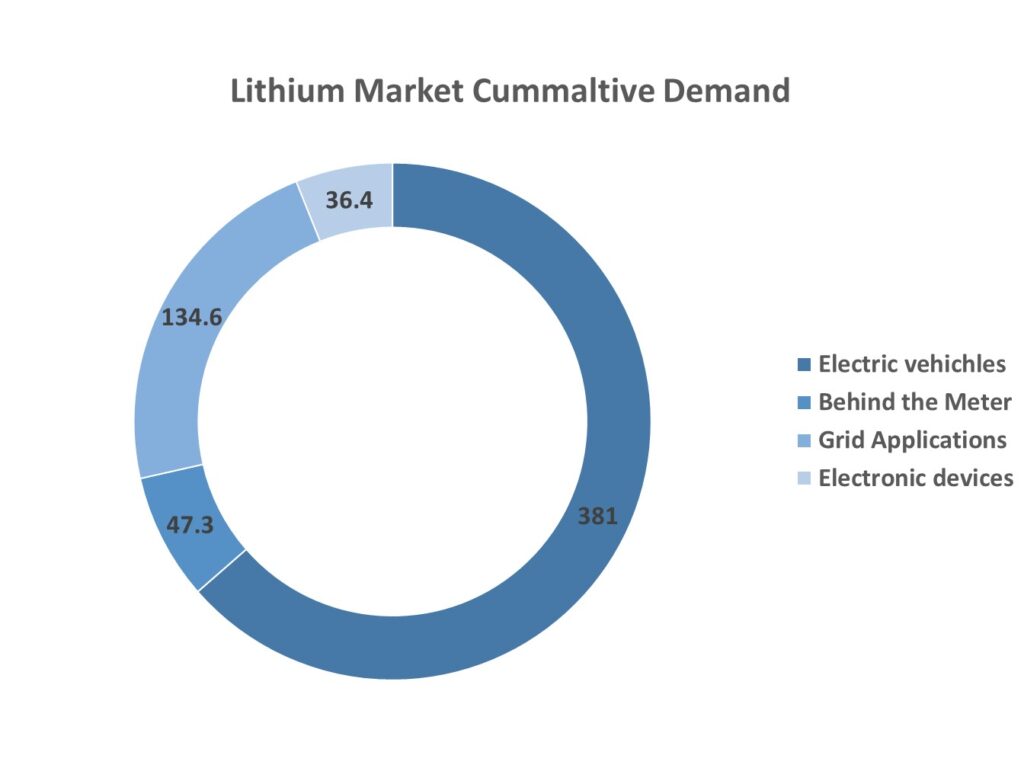

India’s lithium-ion battery market is set for a massive jump, reaching a value of about USD 2.48 billion by the end of 2023. By 2028, the market is expected to grow to USD 5.49 billion, with a significant growth rate of 17.21% from 2023 to 2028. In India, the potential for battery storage is huge, with the total cumulative potential reaching a remarkable 600 GWh by 2030. Electric vehicles (EVs) and electronics (behind the meter) are likely to be key factors driving the widespread adoption of battery storage solutions in India. This growth highlights the increasing importance of lithium-ion batteries in the country with a promising outlook for both market value and cumulative potential for battery storage.

Lithium-Ion Battery (LIB) Recycling in India

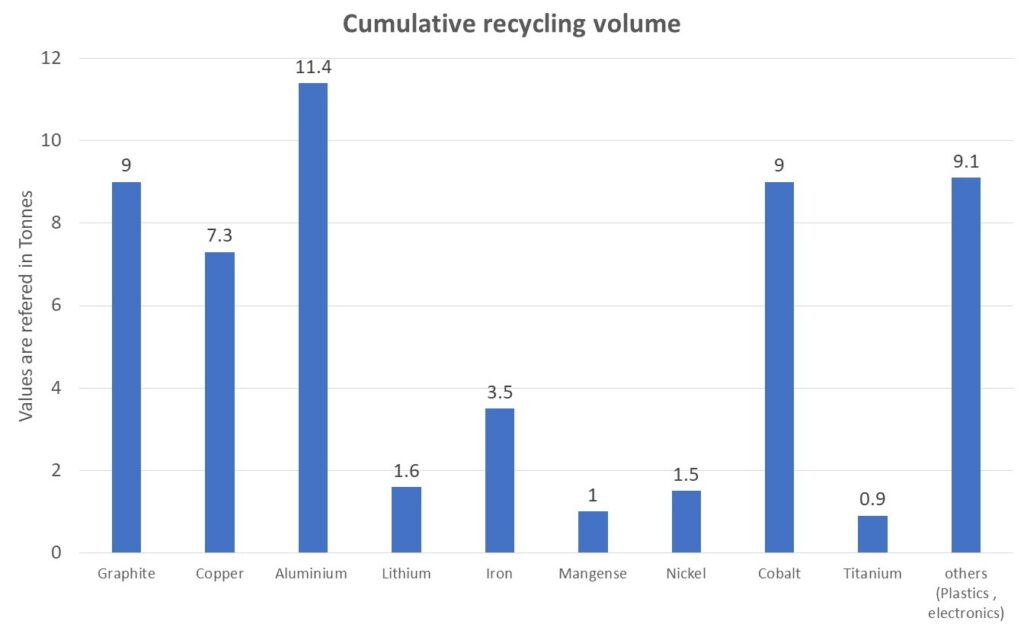

Cumulative demand and recycling potential 2022-2030

Challenges and Opportunities

Despite limited domestic resources for battery metals, India’s lithium-ion battery industry faces challenges. Recycling becomes crucial, providing a secondary source and reducing import reliance. However, the lack of strict regulations for battery disposal poses environmental risks. A structured recycling ecosystem is vital to minimize these hazards. Moreover, geopolitical concerns and dependence on China for battery components add to the challenges. Recycling can help mitigate these risks by fostering domestic production and increasing resilience in the face of global uncertainties.

One major worry is the environmental strain caused by metal mining, which increases emissions, water use, and deforestation. Recycling offers a viable substitute, lowering the environmental effects and requiring less virgin mining.

Ultimately, one of the most important aspects of the sector is price discovery for used electric vehicle (EV) batteries. To determine the batteries’ resale value, a healthy recycling market can be crucial in fostering investor trust and increasing the range of financing choices available for electric vehicles.

Breakdown of EV Market in India

- The electric vehicle market in India is experiencing rapid growth, with electric three-wheelers (E3Ws) leading the charge, accounting for 40% of total three-wheelers sold in FY21. Electric two-wheelers (E2Ws) are also gaining popularity, especially in metro cities, while electric four-wheelers (E4Ws) and electric goods vehicles show promising potential for growth.

- Recycling Potential of EV Industry

| Electric vehicles | LFP | LMO | NCA | NMC111 | NMC662 | LTO |

| Cumulative recycling volume 2022-2030 (GWh) | 11 | 0.4 | 4.3 | 3.9 | 31.8 | 7.5 |

| Cumulative recycling volume 2022-2030 (thousand tons) | 76.8 | 2.6 | 15.4 | 18.5 | 149.7 | 92.3 |

- The recycling potential of electric vehicle batteries varies depending on the vehicle type. Two-wheelers and three-wheelers have limited second-life potential due to their higher number of charging and discharging cycles. On the other hand, electric four-wheelers and e-buses exhibit higher second-life potential, with an estimated 60% of retiring batteries expected to be reused in various applications.

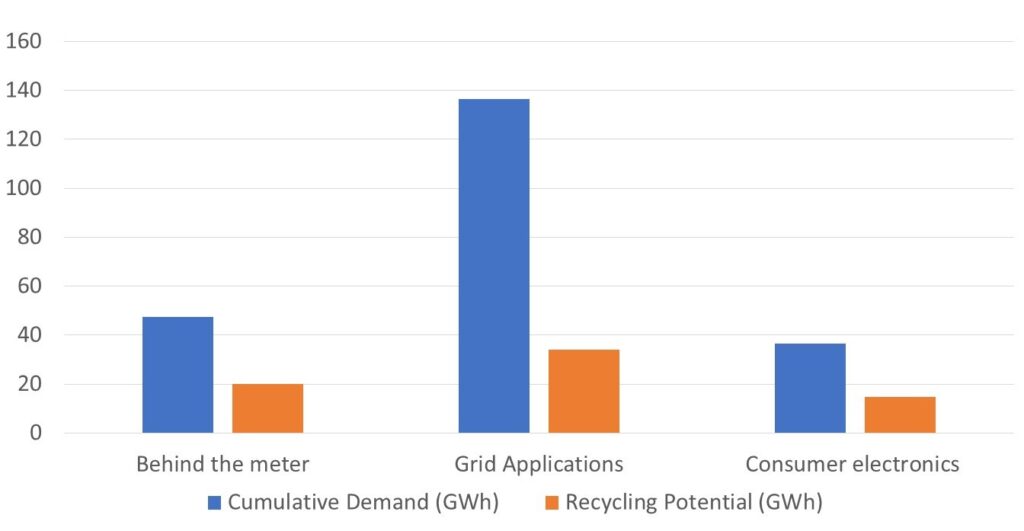

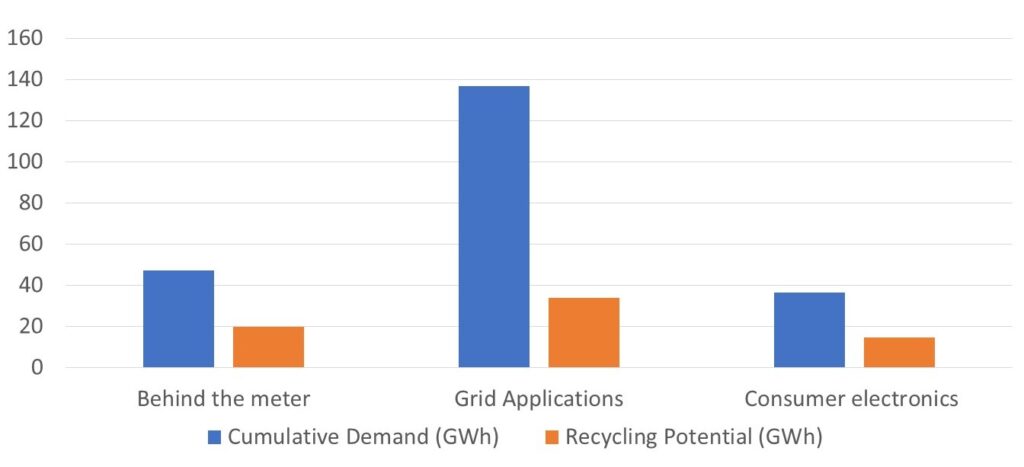

Behind The Meter (BTM) Applications and Consumer Electronics

Battery recycling in India is expanding with new opportunities in areas beyond traditional applications. Telecom and UPS backup systems are contributing to the growing demand for battery recycling. India’s dominance as a global telecom market drives the need for reliable power solutions, leading to increased battery consumption. Consumer electronics are also a major player in the Indian lithium-ion battery market. Laptops, smartphones, and tablets substantially contribute to battery demand. By 2030, the consumer electronics sector is projected to provide around 14.7 gigawatt-hours of recyclable batteries. This highlights the integral role of consumer electronics in driving the demand for recycling solutions in the evolving landscape of India’s lithium-ion battery market.

Recycling Potential of Grid Applications + BTM

| Stationary storage (BTM + grid) | LFP | LMO | NMC | NCA |

| Cumulative recycling volume 20222030 (GWh) | 48.6 | 0.9 | 3.1 | 0.9 |

| Cumulative recycling volume 20222030 (thousand tons) | 338.3 | 6.3 | 14.5 | 3.4 |

Challenges and Opportunities

- Despite the growing demand for lithium-ion batteries, India faces several challenges in establishing a robust recycling ecosystem. Limited domestic sources of critical battery metals, environmental hazards from informal recycling practices, and geopolitical risks from global supply chain disruptions are some of the challenges that need to be addressed.

- However, there are also significant opportunities in the lithium battery recycling market. Establishing comprehensive recycling policies and incentives, investing in research and development of sustainable recycling technologies, and promoting a circular economy approach can accelerate the growth of the recycling industry in India.

India faces hurdles in developing a strong recycling system for lithium-ion batteries. These challenges include a lack of domestic metal sources, environmental risks, and global supply chain issues. However, there are also opportunities for growth in this sector. India can implement comprehensive recycling policies, offer incentives for recycling, and invest in eco-friendly technologies to boost the industry. Furthermore, embracing a circular economy model that focuses on recycling and sustainable resource management could yield substantial benefits. By tackling these challenges and capitalizing on opportunities, India can foster a thriving and sustainable lithium battery recycling sector.

Recycling Market Potential

- The Indian LIB recycling market is nascent but expected to grow rapidly by 2025, fueled by increasing EV and grid storage adoption.

- LFP, NMC, and LCO chemistries will dominate. Those containing nickel and cobalt are most attractive to recyclers due to their value.

India’s Lithium-Ion Battery (LIB) recycling industry is just starting out, but it will likely grow a lot by 2025. This growth will be fueled by the increasing popularity of electric vehicles (EVs) and grid storage options. Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), and Lithium Cobalt Oxide (LCO) are expected to be the most common types of batteries recycled. Recyclers are especially interested in batteries with nickel and cobalt because they are worth more. The LIB recycling industry in India is expected to grow quickly as people become more interested in green energy. This will give companies that focus on recycling valuable chemicals a lot of good business opportunities.

Recycling Technologies

- Pre-treatment: May involve discharging, dismantling, sorting, and thermal (pyrolysis) or mechanical processing to prepare batteries for further recycling.

- Pyrometallurgy: Extracts a metal alloy containing cobalt, nickel, iron, and copper. This alloy undergoes further processing to recover individual metals.

- Hydrometallurgy: Uses acid-based leaching, solvent extraction, and other techniques to produce pure metals or metal salts for battery manufacturing.

- Emerging Technologies Direct recycling seeks to separate, recondition, and directly reuse cathode and anode materials, shortening the process and maximizing recovery.

As India progresses towards electric vehicles and renewable energy sources, the need for lithium-ion batteries is rapidly increasing. To handle the rising number of batteries reaching the end of their useful life and minimize their environmental impact, India must prioritize developing effective recycling systems. Solving current problems and leveraging new chances can make India a leader in lithium battery recycling, creating a more sustainable future. To address environmental and resource concerns while promoting a circular economy, it is essential to create a comprehensive lithium-ion battery recycling ecosystem.

Moreover, government initiatives and incentives can boost the expansion of the recycling industry. Continuous research is also crucial to developing more effective and environmentally friendly recycling techniques, ensuring a smooth and sustainable shift toward recycling practices.