These days people often ask me questions like – what’s happening to ESG? Where is it headed? Which side are you on? I thought of sharing my views here to spare myself some energy in the future.

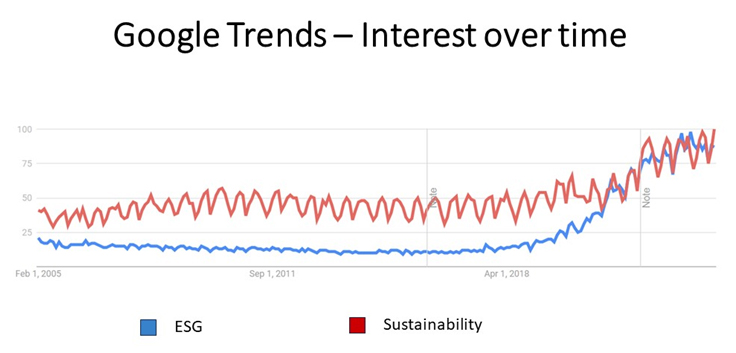

The interest in ESG is still high as shown in the Google Trends graph below. But what is surprising is the growing negative press it is getting these days.

Let me rewind a bit. In the early part of 2019, ESG was sounding very much like the Eagle’s song “New Kid in Town.”

“There’s talk on the street, it sounds so familiar

Great expectations, everybody’s watching you

People you meet, they all seem to know you

Even your old friends treat you like you’re something new.”

The media worldwide has been covering the sudden rise of ESG extensively so much that ESG moved into the boardroom very fast. I doubt even cyber security did it this fast.

The ESG wave was so strong in 2019 that no resume was complete without a mention of knowledge or expertise in ESG. I remember interviewing an ‘ESG expert’ during this phase. I even posted this on LinkedIn. Here’s a glimpse of that post:

ESG Expert: ESG is very important now for investors and I have analyzed many companies on ESG.

Me: OK, so tell me, What is IUCN?

ESG Expert: What has it got to do with ESG?

Me: Sorry, tell me how do companies calculate Scope 3 emissions?

ESG Expert: I am not a climate change expert, I am an ESG Expert.

Me: OK. Under ESG, do you evaluate companies on Human Rights?

ESG Expert: Yes. Child Labor is an important aspect.

Me: What is a clawback policy?

ESG Expert: I am no governance expert, I said I’m an ESG expert.

ESG became a big deal because investors were driving it. The world follows the money. The Investors were driving this because some of the risks were starting to precipitate, and it was an outside-in pressure for the companies from a key stakeholder. It found more momentum with major rating agencies acquiring the smaller ESG ratings between 2018 and 2020 and between 2019 and 2020, the ratings were made public.

The real tipping point was with the shareholder activism on ESG that even made changes to the boards. The shock waves were felt. It was a period in which, like in the Eagles song, even old friends (Sustainability fraternity) treated ESG like it was something new.

Don’t Say ESG Today

Fast forward to today: We are passing through a phase, especially in some geographies, where it seems almost a crime to use the term ESG. Business leaders who frequently used the term have stopped using it and have adopted fancier terms like Responsibility and Stewardship.

ESG made it to the big political stage too. The US Congress voted against ESG investments and President Biden used his first veto to uphold it.

Even the academic fraternity now seems divided on this subject. Some of the greenwashing episodes in the financial sector during this time also added fuel to the fire. With the current political polarity so high and the US being closer to elections, the negative sentiments are high with several articles on mainstream media with titles like ‘ESG is Dead, RIP ESG,’ ‘ESG Beyond Redemption.’

Even the regulations and standards are not using ESG. They seem to prefer the Corporate Sustainability Reporting Directive in the EU, and Business Responsibility and Sustainability Reporting (BRSR) in India. Even the independent standard-setting body under IFRS is called the International Sustainability Standards Board, although the standards do not define sustainability.

For a sustainability professional, this is still encouraging. For someone who has spent almost three decades in this field – the first 15 years it was an empty arena, the next 10 years private gatherings, and now it has turned into an active debate.

I firmly believe that just like how the Design Thinking movement took off where designers moved back and forth through divergence and convergence, it is important for ESG and Sustainability to go through such cycles. Divergence can create space and possibilities and then convergence can bring focus and direction. The fad must go and the real should remain. Peter Vanham, in one of his Impact Reports titled “ESG is Dead: Long live E, S and G”, compared ESG to Bruno in the Disney movie Encanto – We don’t talk about it, no, no. But it is still with us.

Santhosh Jayaram

Global Head, Sustainability, HCL Tech Ltd

The author’s views are personal

[…] NOTE – This article was originally published in sustainabilitynext and can be viewed here […]